Your Comprehensive Guide to VAT Registration

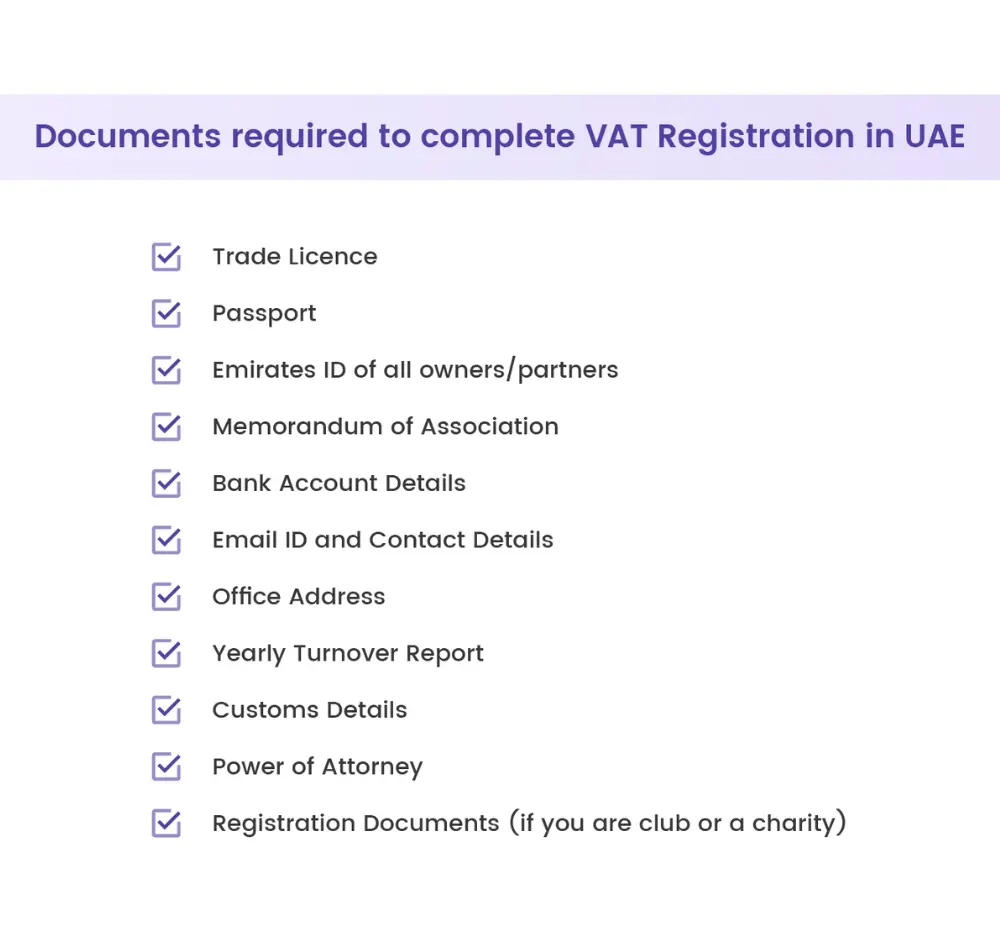

Navigating Value-Added Tax (VAT) registration and submission is essential for businesses operating in regions where VAT is mandatory. Effectively managing VAT not only ensures compliance with local tax regulations but also helps businesses avoid significant penalties. Our guide provides a detailed overview of the VAT registration process, submission requirements, and the advantages of outsourcing these responsibilities to experts.